Pros

Cons

Disclosure: As a rule, we review the best cryptocurrency exchanges and brokers. This is not financial advice and does not exclude you from the risk of loss that comes with trading volatile financial instruments like cryptocurrencies.

Jump to Section

Opening an account on Uphold involves a simple three-step process, one of which involves two-factor authentication. The procedure is more or less the same for US and non-US residents, except for China residents, who’ll have to submit a government-issued identification number to complete the registration process.

Here’s a step-by-step overview of the process –

Note – Read through the terms and conditions in detail before you sign up.

Choosing Uphold should be a priority for those new to crypto and looking for a simple, non-complicated way to move funds and trade efficiently. Uphold also holds an allure for users looking at crypto as a way to do remittances and make payments for everyday use.

Uphold can also be a safe haven for those who are only interested in holding digital assets in cryptocurrencies, precious metals, stocks, and even fiat currencies.

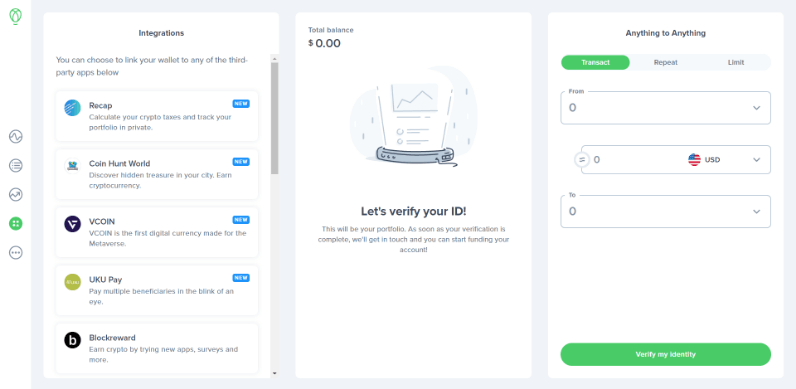

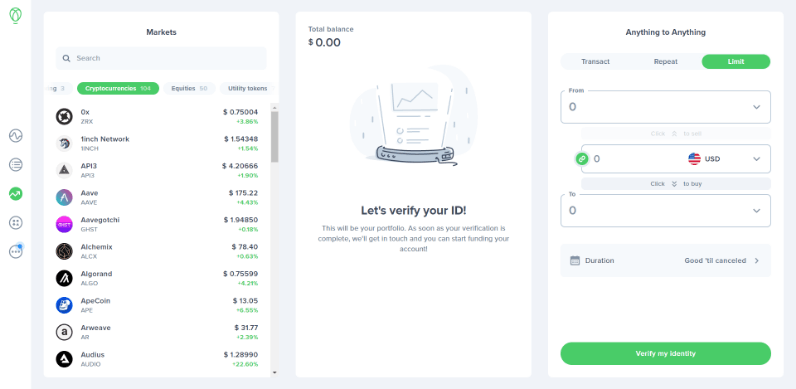

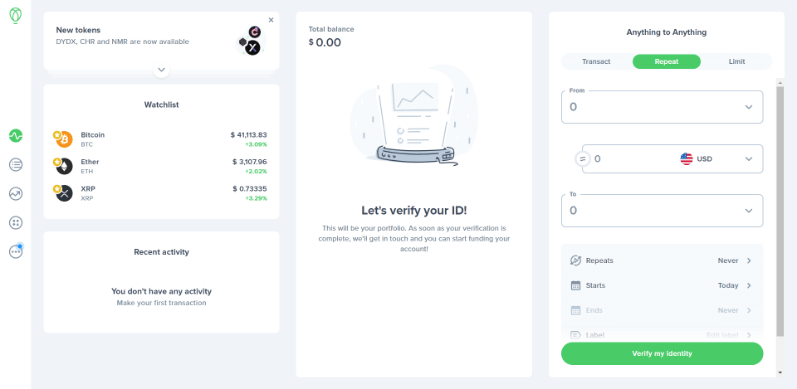

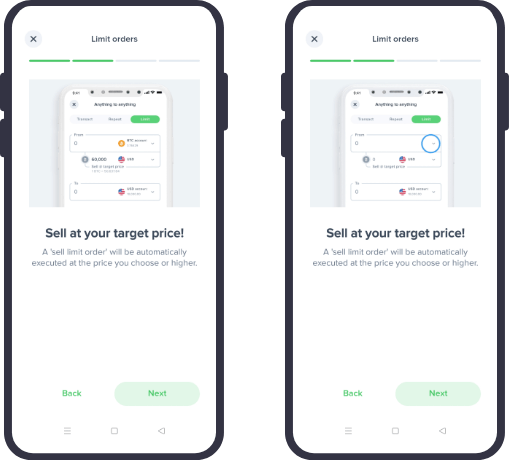

Here’s a glimpse of a few Uphold features that might appeal to you –

With this feature, you can invest or trade assets directly, without multiple transfers, using a bank account, credit/debit card, or a cryptocurrency network with 0% commissions. You can also trade between assets of different classes with one step.

This feature makes it easy for you to invest in your favorite assets. You can set up recurring transactions to buy Bitcoin, Ethereum, stocks, or any asset of your choice daily, weekly, or monthly.

Accepted at 50MM merchants and almost all ATMs across the world, the Uphold debit card (physical and virtual) allows you to spend any of your existing assets to make a purchase. You can also earn 1% cashback for every USD-sourced transaction and 2% back of the cryptocurrency used to buy a cryptocurrency.

Uphold’s handy reference guide – Cryptionary – lists a few of the most common terms you may come across as you explore the world of cryptocurrencies.

Uphold works well on both web and mobile platforms. The following features of both platforms stood out for us –

The technology Uphold utilizes for its anything-to-anything asset exchange is remarkable. It is the only exchange that does not force you to rely on USD or USDT before you can swap assets.

Relatively, Uphold is safe. As a legal platform in the financial space, Uphold HQ Inc. must report to the IRS on all taxable transactions that happen on its platform. This element of oversight makes the crypto exchange platform safe and secure.

In addition, Uphold holds more than 98% of its assets in cold storage, that is, on computers that are not connected to the internet. This takes control of assets away from the reach of hackers, even in the event of a security breach.

Uphold also has a strict KYC rule that sees users submit email addresses and a government-issued ID and a contact number. Uphold accounts can also get under review with a breach of the KYC regulations.

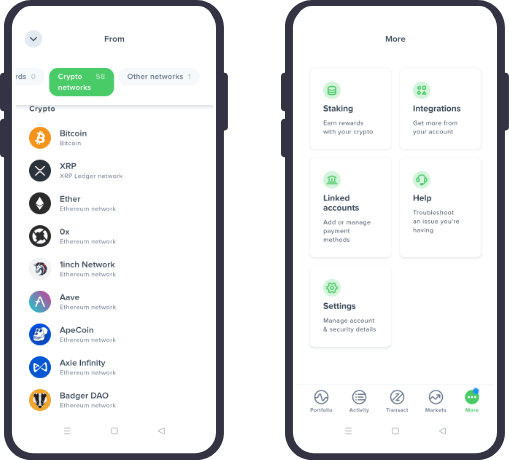

Uphold supports 115 cryptocurrencies. A few of them are –

Uphold offers many ways to fund and/or withdraw your assets from their platform. You can view step-by-step instructions on how to fund your account with a credit/debit card or a bank account or using a wire transfer on its official website. Alternatively, you can also view similar directional instructions on how to withdraw funds.

These directions are simple to follow and are often accompanied by supporting images or videos. Funding your Uphold account is typically an instant process while withdrawing the money can range from instantaneous to 1-2 business days.

Uphold does not typically charge fees or commissions; instead, a spread varies depending on the cryptocurrency or fiat currency of choice. The spread also varies, albeit slight, for US and non-US residents.

It does have a network fee that is charged when you withdraw to external crypto wallets. It may vary depending on network congestion.

|

Transaction Type |

Uphold Fees |

|

Deposit |

Free, except for debit and credit cards with a 3.99% charge |

|

Cryptocurrencies |

Varies between 0.8 to 1.2% on majors. Low volatility coin can be higher |

|

Fiat currencies |

0.2% for national currencies |

|

U.S. Equities |

1% can be higher during the off-market period |

|

Uphold card |

Free |

|

Withdrawal |

A charge of $2.99 and $3.99 for crypto and bank withdrawals, respectively. |

Note – Since the spread can vary owing to many factors, we advise checking the rate on your preview page before confirming the transaction to avoid any surprises.

Uphold’s Referral Program gives you and your referee* the chance to receive US$20 worth of bitcoin in exchange. This program is available till the end of this month and is subject to terms and conditions.

Uphold has physical and virtual cards that give instant access to your assets and even offer cash-back. You will have to join a waitlist to be able to access the physical card.

The company has an extensive FAQ on the site; aside from this, there is email support. Uphold users can also get help and walkthroughs on Twitter. There is no live chat or phone support available. Hence, it is no surprise that many users do not find customer support at its best.

Here’s how Uphold compares against other exchange platforms -

Stay on top of all things Uphold.

Uphold has recently released two new Tier 4 tokens to buy, hold, sell, and send worldwide. These are HopProtocol (HOP) and Aleph Zero (AZERO). Also, the Luna2 airdrop has already been rolled out to Uphold's users and will continue in service for the eligible ones.

Uphold has recently listed the OP, Optimism token; it is now available for all its users to trade worldwide. Optimism is a tier 4 asset that allows the users to buy, hold, sell, or send it.

The 15 new tokens are tier 3 except for TFUEL, which is tier 4. They are -

Author :

Osueke Henry

Osueke Henry is an experienced blockchain writer who creates Industry-leading content that helps founders, investors, startups, crypto, and blockchain enthusiasts connect with their audience and win investment through the written word.

Uphold is both an exchange and a wallet. It is a digital asset channel that allows users to buy, hold and send digital assets. It is not just for cryptocurrencies; several other assets can be added.

You can be sure that Uphold is safe – with the process and the measures put in place to ensure security, you can trust Uphold. The exchange is even encrypted, ensuring that the risk of an external breach is significantly reduced.

Also, Uphold holds more than 98% of its assets in cold storage, that is, on computers that are not connected to the internet. This makes it extremely difficult for hackers to steal the assets of all its users.

There is a way to avoid Uphold fees. If you fund your account using crypto or a transfer from another Uphold account, you will not have to pay any fee.

Uphold is an exchange, not a broker. Exchanges match buyers and sellers while serving as the go-between. Uphold is a well-known cryptocurrency exchange, and it allows transactions to occur by merging buyers with sellers.

On the other hand, brokers transact directly with their end-users to achieve this. Brokers provide speculative contracts on the prices of these digital assets to make the best prices available for their users.

Uphold is in partnership with ihaveCred. The partnership means that holders can earn interests between 3-10% per annum on the crypto they leave in their wallets.

Both Uphold and Coinbase are among the largest crypto exchange platforms available in the current market. On comparison, you’ll find that they are comparable in terms of security, wallet integration, etc.

In other aspects, however, things are different. You’ll find that Coinbase offers more currencies, a chance to earn free cryptos, and an easier to use interface across their website and mobile application. Uphold, on the other hand, offers better pricing, the chance to trade stocks and precious metals, trade between supported asset classes with no restrictions, and more.

Bottom line, it’s hard to decide on one as the two platforms appeal to different investors. We suggest taking time to navigate through both and stick to the one that best suits you.

Since its inception, Uphold has never been hacked. The company has its own Security Operations Center working round the clock to monitor and act on any suspicious activity.

Uphold also uses a combination of external cyber security firms and professionals to check for any vulnerabilities across the platform. In addition, the security team conducts regular audits to ensure employees are compliant with standard security measures.

In case you fear your Uphold profile has been compromised, you can reach out to Uphold support via email and state the same.

No, Uphold is not FDIC insured. It does, however, offer its own insurance of sorts.

Since regular USD deposited into the exchange is not insured, you should turn to Uphold’s USD Stable Coin after depositing your money. It is backed in a 1:1 ratio with physical dollars in banks that are FDIC insured.

It means that for every dollar you spend, there is a US dollar counterpart in the bank backing your digital money.

It means that the Uphold team has blocked your account temporarily to investigate it. It is done to protect your account or others. You can contact their support team for further assistance.

Uphold has a verification process in place to secure your account and your funds. It is a simple two-minute process where you have to submit live photos of yourself and government-issued IDs.

If you’re a U.S. citizen or resident, Uphold is required by law to ask you to hold and add your social security number to your account. The platform cannot issue your 1099 Tax Form, needed for your annual tax filing, without it.

While Uphold doesn’t charge deposit fees, withdrawal fees, or trading commission, it charges a spread every time you make a trade. It also has network fees which are charged when you withdraw money to external crypto wallets and vary based on network congestion.

Uphold charges a spread for buying and selling from Individual account owners of the UK and the US. Both the buying and selling spread percentage varies for each asset and ranges from 0.95%-1.25%.

When you apply for Uphold’s debit card, you get a physical and virtual card. You can spend any of the assets you have on the platform. You can earn 1% cashback for every USD-sourced transaction and 2% back of the cryptocurrency used to buy a cryptocurrency.

You can simply go to Uphold’s website and sign up to join the waitlist for this card.

By clicking submit, you agree to the Terms and conditions.

Our top 3 picks